MORE FREE TERM PAPERS MANAGEMENT:

|

|||||||||||||||||||||||||

Cost And Management Accounting

COST LEADERSHIP

Economic recessions usually spark a renewed interest in rigorous, detailed and effective cost management practices. Given the lack of orientation, preparation or temperament for a recessionary period, the first response and reaction of most managers typically involves a "siege mentality" that includes: protecting one's turf; battening down the hatches; slashing all general ledger expense categories; and viewing the finance's department's role as a head-count "executioner."

In past recessions, companies such as Chrysler Corp., Johnson& Johnson

and several units of General Electric Co. have improved their profitability,

productivity and performance with the rigorous, systematic and effcient

use of business process analysis, activity based costing and cycle time

compression metrics, among other things. Accounting and finance executives

in winning companies have built career lasting reputations for excellence

by leading cost leadership initiatives with the cooperation and support

of their business partners.

Successful cost-leadership initiatives often involve more than a singular

tool. Imagine trying to complete a major home repair project with a limit

of just one tool; it would be virtually impossible to do. The same is

true for cost-leadership initiatives.

Surveys at a variety of companies in various industries have found that

the overall reputation of the finance and accounting function and leadership

has improved materially in the last two decades. Managers and leaders

in product development, marketing, manufacturing, logistics, distribution

and other functions may be more open to what an accounting or finance

professionals can offer with a view toward supporting profitable business

growth.

The time may be ripe to pursue aggressive, well-planned and sophisticated

cost-leadership initiatives. It is of paramount importance to lay a strong

foundation for success by considering many of the behavioral, measurement,

cultural and communication issues in the planning phase.

In his 1980 classic Competitive Strategy: Techniques for Analyzing Industries

and Competitors, Porter simplifies the scheme by reducing it down to the

three best strategies. They are cost leadership, differentiation, and

market segmentation(or focus). Market segmentation is narrow in scope

while both cost leadership relatively broad in market scope.

Cost Leadership Strategy

This strategy emphasizes effciency. By producing high volumes of standardized products, the firm hopes to take advantage of economies of scale and experience curve effects. The product is often a basic no frills product that is produced at a relatively low cost and made available to a very large customer base. Maintaining this strategy requires a continuous search for cost reductions in all aspects of the business. The associated distribution strategy is to obtain the most extensive distribution possible. Promotional strategy often involves trying to make a virtue out of low cost product features.

To be successful, this strategy usually requires a considerable market share advantage or preferential access to raw materials, components, labour, or some other important input. Without one or more of these advantages, the strategy can easily be mimicked by competitors. Successful implementation also benefits from:

1. process engineering skills

2. products designed for ease of manufacture

3. sustained access to inexpensive capital

4. close supervision of labour

5. tight cost control

6. incentives based on quantitative targets.

A firm attempts to maintain a low cost base by controlling production costs, increasing their capacity utilization, controlling material supply or product distribution and minimizing other costs including R&D and advertising. Mass production, mass distribution, economies of scale, technology, product design, learning curve benefit, work force dedicated for low cost production, reduced sales force, less spending on marketing will further help a firm to maintain low cost base. Decision makers in a cost leadership firm will be compelled to closely scrutinize the cost effciency of the processes of thefirm. Maintaining the low cost base will become the primary determinant of the cost leadership strategy. For low cost leadership to be effective a firm should have a large market share. New entrants or firms with a smaller market share may not benefit from such strategy since mass production, mass distribution and economies of scale will not make an impact on such firms. Low cost leadership becomes a viable strategy only for larger firms. Market leaders may strengthen their positioning by advantages attained through scale and experience in a low cost leadership strategy. To illustrate this we are looking at the steel sector and specifically at TATA Steel as the cost leader.

TATA Steel

Tata Steel, India’s largest steel company and the world’s sixth-largest by capacity is the cost leader in the steel manufacturing sector. Tata Steel owns raw material assets such as coal and limestone mines through joint ventures or completely, with the assets spread across countries such as Australia, Oman and Mozambique. Tata Steel and stateowned SAIL have largely been able to withstand raw material price fluctuations due to captive iron ore mines. Tata Steel is also one of the least cost markers of steel in the world. Other private steel companies, hit by steep iron ore and coal prices, have passed on the hikes to the customers, prompting the government to clamp down on price increases to control inflation.

Tata Steel, which bought out global major Corus last year doubled its profits based on the acquisition. TATA Steel and Corus together sell more than two-thirds of their production in Europe. The consolidated full year net profit for Tata Steel stood at Rs 12,321.76 crore, com-pared to Rs 4,165.61 crore, due to contribution from Corus businesses. The consolidated reve-nue for the full year totaled Rs 1,32,110.09 crore, compared to Rs 25,650.45 crore last year. Anglo-Dutch steel maker Corus was acquired in January last year for $13 billion.

In 2006 TATA Steel used to produce 6.4 million metric tonnes of steel and was ranked 45th in the world by capacity. In 2007 post acquisition of Corus its capacity became 26.5 mil-lion metric tonnes and was ranked 6th in the world. Sail is ranked 19th in the list. The other companies preceding TATA Steel are Arcelor Mittal, Nippon Steel, JFE, POSCO and Bao Steel. However, while most other companied are facing the challenge of low margins, TATA Steel has remained positive because of the cost leadership it maintains. In the iron and steel industry, the prices are determined by the market and hence all that a producer can do is cut down on its costs ti sustain its margins.

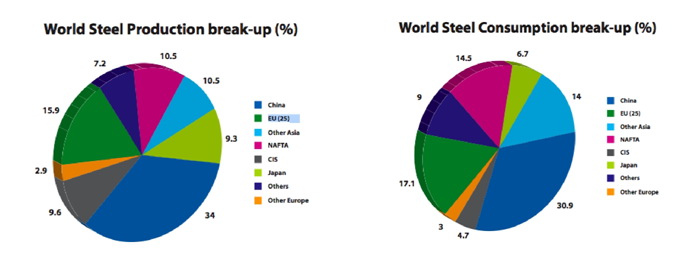

Surprisingly, China happens to be the highest producer and consumer of Iron and steel in Asia. It has been illustrated in the pie chart below. This presents TATA Steel with a sea of opportunities as the highest consumer of Steel in the world is its neighbor.

The key factors that work for TATA Steel are as follows

1. Management is confident of passing on to customers the impending raw material cost in-creases.

2. Continuous improvement programs at Corus to result in savings/benefits of GBP 300 mn in FY08. In comparison the FY09 savings/benefits is USD 350 mn.

3. Regards the total acquisition synergy benefits of USD 450 mn, a run rate of 30% (USD 135 mn) has already been achieved.

Key Data on the Steel industry

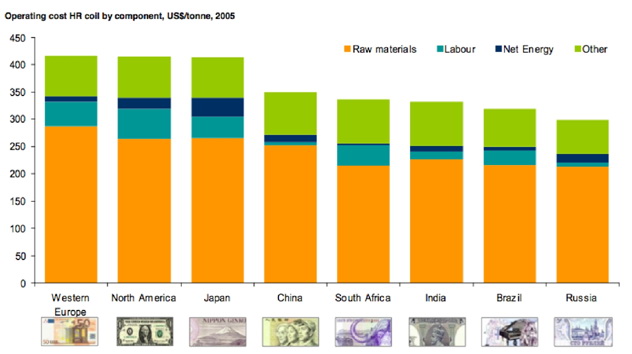

India is among the least cost producers of Steel and it is reflected

in the graph below:

Cost of raw material in India is much cheaper when compared to other countries; specially China. As we can see in the figure below, India is among the cheapest countries to source steel.

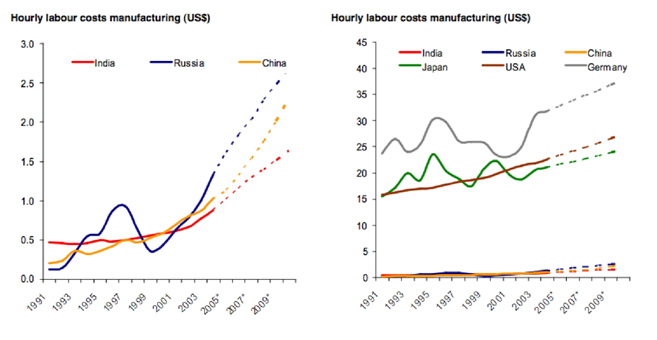

India also has the cheapest labour costs for a company. Although,Brazil

and South Africa have cheaper raw material cost, they have a higher labour

cost to compensate. TATA Steel has access to one of the cheapest labour

markets and hence is in a very strong position in minimizing its cost

of production. However, it must be noted that Indian labourers are not

the most efficient of labourers. They are much below the world average

when it comes to effciency.

As the Industry data suggests, Indian workers are not the most effcient

among workers. TATA Steel in comparison pays a heavy sum when compared

to its competitors. However, with the acquisition of Corus, it is bound

to improve as corus has one of the most effcient workforces. Japanese

Nippon Steel and Korean POSCO rule the roost when it comes to productivity.

If only TATA Steel can improve upon employee productivity, it can further cut its costs to a certain extent. It must however be noted that labour cost accounts to only to 7-8 % of TATA Steel’s revenues and hence may not hold too much of relevance as yet. But as the times goes, it is bound to be an issue and must be checked immediately. The data on cost as a percentage of revenues is given below.

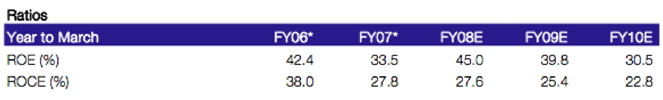

Furthermore, TATA Steel also has a high return on investment and capital employed which is furnished below:

Although it has been declining, it is expected since the world steel

prices have taken a beating since the economic crisis came into the picture.

As we can see in the graph below, India has the competitive advantage

in labour beating all countries including China.

According to TATA Steel estimates, it’s operating margins will still remain

close to 20% despite the global slowdown. The EBITDA of 17% for both 2009-10

indicates why it pays to be the cost leader. The balance sheets of both

Nippon Steel and POSCO would indicate that they have cut production to

brace for the coming recession. However, the standalone data of TATA Steel

during the period has shown an increase of 20%. (source: TATA, Nippon,

POSCO annual reports)

Another important factor adding to the operating expenses of the company

includes transportation and freight charges. Since TATA Steel has to source

its raw materials from many points such as Australia and Africa, freight

becomes a major component of of its cost. Also, It has production facilities

in multiple locations and sourcing becomes a important concern. It has

been observed that these have been on the rise yet have been volatile.

To neutralize this effect superior cost control in the areas where it

possible is highly important. While on one hand, there are uncontrollable

costs, it is the controllable costs that the company must aim to cut back

on. In this area, TATA Steel has been highly successful.

Organizing to implement a cost leadership strategy requires particular consideration to the organizational structure, management controls, compensation policies, and implementing cost leadership strategies. The organizational arrangements and implementation tools should not only fit but reinforce the strategy. Porter (1980) has divided requirements of overall cost leadership strategy into “commonly required skills and resources” and “Common organizational requirements”. Commonly required skills and resources when implementing overall cost leadership are sustained capital investment and access to capital, process engineering skills, intense supervision of labor, products designed for ease in manufacture, and low-cost distribution systems. Common organizational requirements constitute of tight cost control, frequent, detailed control reports, structured organization and responsibilities, and incentives based on meeting strict quantitative targets. According to Barney & Hesterley (2006), few layers in the reporting structure, simple reporting relationships, small corporate staff, and focus on narrow range of business functions are elements of organizational structure that allow firms to “realize the full potential of cost leadership strategies”. Management control systems that support the implementation of cost leadership include tight cost control systems, quantitative cost goals, close supervision of labor, raw materials, inventory, and other costs, and a cost leadership philosophy. Examples of good compensation policies are rewards for cost reduction and incentives for all employees to be involved in cost reductions.

With the example of TATA Steel, we can see how a cost leadership strategy can serve a company in good stead. As we see companies like Nippon steel are crumbling under the weight of their size and are taking cover trying to improve their margins by cutting down staff and so on. On the other hand a strict cost control program has resulted in good returns to TATA even in recessionary periods.

Cost Leadership At Reliance Industries

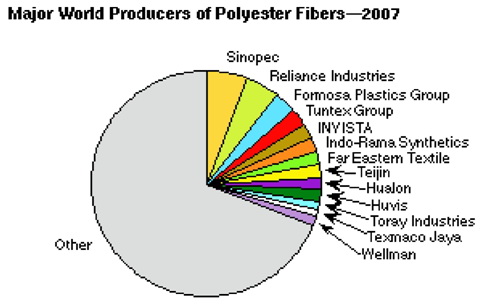

In the 2005 Annual General Meeting it has been stated that Reliance has become a global leader in various business activities based on innovation and cost leadership (Reliance Industries Limited, 2007). Reliance today enjoys a 7 % global market share in the textile polyester business. India, China and South East Asia have nearly 80% of global textile polyester capacity, along with presence in downstream textiles. Reliance commissioned a 730,000 tonnes per year PTA plant at Hazira. This makes Reliance the fourth largest producer of PTA in the world.

Low costs are achieved in two ways:

1. More effcient production arising from experience: Reliance has been in this industry since 1977 and thus the experience lead them to find more ecient methods of production. The Polyester manufacturing is a complicated/technical process thus Reliance have a competitive advantage as the experience advantage will be greater and diffcult to capture in short term.

2. Economies of scale: Reliance is the Global leader and thus due to high demand and produc-tion lead the company to have effcient size of plant, management structure and so forth. Reliance being a Global player have enough sales to justify investing in additional capacity to capture economies of scale.Reliance will also have a cost advantage because competitors may not be able to match the scale because of capital requirements (barrier to entry) as the firm works in many countries and across the international borders.

3. Through innovation in production methods, leading to new techniques of production or better organization of production: Reliance always believed in innovation and introduced many new methods into the Indian Industry of Polyester.

4. Plentiful source of low cost labor: Reliance has its manufacturing units and head Offce in India which helped the company to have a plenty of raw material and skilled labour at low-est cost.

5. Differential Low-Cost Access to Productive Inputs: Reliance has been founded by Dhiru Bhai Ambani which gave the firm cost advantage over the others because he introduced/ pioneered the new Polyester manufacturing in India

The benefits of low cost strategy are:

1. The Cost leadership helps the Reliance to survive in the price war against its competitors.

2. Supernormal profits generated from increase in market share and demand helps Reliance Group to reinvest some funds into their internal business activities to improve quality and continue cutting costs.

Risks associated with low cost strategy are:

1. Over-emphasis on costs makes Reliance Group inward looking, production orientated and poorly focused on customer needs.

2. There can only be one lowest cost producer in the industry.

3. Gains to be made through learning- i.e. through more effcient production are usually minimal and the most effcient scale of the plant can be copied. That is "many routes to a low cost position can be easily copied."

4. If Reliance’s competitors have other profitable products, then being a lowest cost producer is not enough to survive the price war: competitors can cover their fixed cost with profit from the other lines and price close to what the variable cots are.

Due to above risks as mentioned we would recommend the company to not fully de - pend on cost leadership. Reliance should invest ion R&D to keep innovating its product and offer variety to customers.

Polyester Margin environment

Cotton, the second largest fibre in demand, is witnessing a firm trend in prices. Falling stocks accompanied by declining acreage has increased prices of cotton by more than 26% in the previous year. Global quest for biofuels is impacting the agriculture economies world wide. In February 2008, cotton futures for May 2009 went up to as high as 97 cents per pound ($ 2,138/ tonne) showing signs of firm undertone. This is one of the highest levels in the last decade.

The United States, the world’s third largest cotton producer, has seen

a 28% fall in acre - age under cotton production for current season (2007-08)

and is likely to see a further drop in the years to come. Most of the

farmers have shifted to planting of corn and soybean, due to robust demand

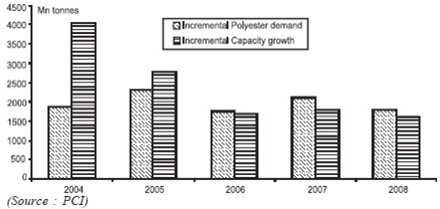

from the bio-fuel industry. Due to rapid additions in polyester capacity

in China, there has been oversupply since 2000. Low margins in the last

few years have reduced incremental growth in polyester capacities in countries

like China. From an incremental capacity of 2 million tonnes over incremental

demand in 2004, currently incremental demand is more than the annual new

capacity creation.

Polyester consumption is growing faster than that of any other fibre.

There are large pockets of population that have low consumption like the

Indian subcontinent and Africa. While the global per capita demand for

all fibre stands at 11 Kgs, with China at 16 Kgs and the US at 38 Kgs,

India is still at less than 5 Kgs and Africa is at less than 4 Kgs. These

regions contribute to nearly half of the world’s population and are witnessing

increase in disposable income with overall economic prosperity. Historically

it is seen that rising per capita income and industrialization increase

textile consumption for both apparel and nonapparel applications. Due

to inherent constraints in growth of cotton, polyester is likely to capture

the maximum share of future growth.

The Domestic Scenario

Currency appreciation has been of major concern for textile exporters in India. Last year, the Indian Rupee has appreciated against US dollar by 7.7%. Textile exports being a highly competitive business, is adversely affected by an appreciating rupee. The Indian Government reduced the import duty on polyester from 10% to 7.5% and again to 5% mid year in Novem-ber 2007. The Government, in an effort to give a fillip to investments in downstream textile industry has extended Textile Upgradation Fund in the 11th Five Year Plan. Benefits of this fund have been extended to technical textiles, which is an underpenetrated segment for industrial and household polyester applications. With a growing presence in domestic textile growth segments like nonwoven, industrial and automotive yarns, Reliance is well positioned to increase its polyester market share over other Indian manufacturers.

Domestic Demand

Polyester witnessed exciting demand growth in the domestic market at 17% over the previous year. POY demand grew by 18% whereas PSF demand grew by 12%. The increased demand for polyester was driven by robust investments in textile sector and PET consuming industries during the previous year.

Touching 28 touching lives. Transforming India. Indian PET bottle resin market grew by 26% and is expected to sustain the growth rate due to a wider scope of increased penetration in carbonated soft drink, mineral water, fruit juice, and healthcare and agro-chemicals segments. Reliance, with a share of 55% in PET market, is the largest player in the country. Production volumes of the Polyester (PFY, PSF and PET) including Trevira and Recron Malaysia, increased by 16.6% to 1,910 KT. Production from the new domestic polyester facility has been placed successfully in the market. The Company has maintained its focus on specialty products which account for 54% and 38% of PSF and PFY production respectively. Reliance’s domestic market share is now in excess of 49%.

New Product Initiatives

1. Copol & Copol blended fabrics.

2. Polyester / Wool / Bamboo blended fabrics with inherent antimicrobial, anti-odor and UV protection properties.

3. Wool / Soya blended fabrics with having similar moisture absorption capabilities as cotton.

4. Durable moisture management in 100% polyester sports wear fabrics.

5. Fire-retardant and water proof tent fabric, providing additional safety from fire hazards.

6. Water and oil repellant fabrics made from eco-friendly recycled polyester.

With continuous improvements and extensive backward integration, Reliance

stands out as the cost leader in its industry. However, it is important

for both TATA Steel and Reliance Industries LTD. to look at sustaining

its cost leadership over the years to come. With effective involvement

of cost control, there is further scope for cutting down on costs and

remaining the undisputed cost leader in its segment. Considering the present

recessionary phase all over the world, Cost leadership will stand out

as the single biggest recipe for success.

BIBLIOGRAPHY

Author Last Name, First Name. “Book Title or Ref-erence Title.” City: Publisher, Date.Webster, Williams. CPA. Accounting for Managers, Mc Graw Hill, 2005

Porter,. E. Michael. Competitive Strategy, Free Press, 1980

Grant,.M. Robert. Contemporary Strategy Analysis, Black-well publishing, (wiley), Fifth Edition, 2007

Homgren, Charles. Datar, Srikanth. Foster, George. Cost Accounting. Pearson Prentice Hall, 2005

Website URLs:

www.allbusiness.com

www.tatasteel.com

www.posco.com

www.nsc.co.jp

www.worldsteel.org

www.ril.com

www.sriconsulting.com

Annual reports:

Annual Reports- TATA Corus

Annual report- Nippon Steel

Annual report- Arcelor Mittal

Annual report- POSCO

Annual report- Reliance Industries

Reports:

India Equity research, Metals and Mining, By Edelweiss November 2008

Cost Leaders in the New World, Steel Consult International

Report on the Polyester Industry: Blacks Academy